Our figure of the month for New Year's Eve 2022: Who is still building – in 2023?

The recent development of building permits has both caused excitement in the construction industry and dampened the anticipation of Christmas and the turn of the year. Increasingly, the question arises whether households can afford to build at all.

Yet the development of construction demand seemed stable until the middle of the year. Despite rising costs for building materials, the growth in demand has continued in recent years. The prices for steel, concrete, ceramics, tar and bitumen, for example, have risen sharply recently. On the one hand, this was due to material shortages - also triggered by the Russian war of aggression on Ukraine – and on the other hand, the continuing high demand for construction despite the scarcity of building materials is responsible for a further price increase and even scarcer materials.

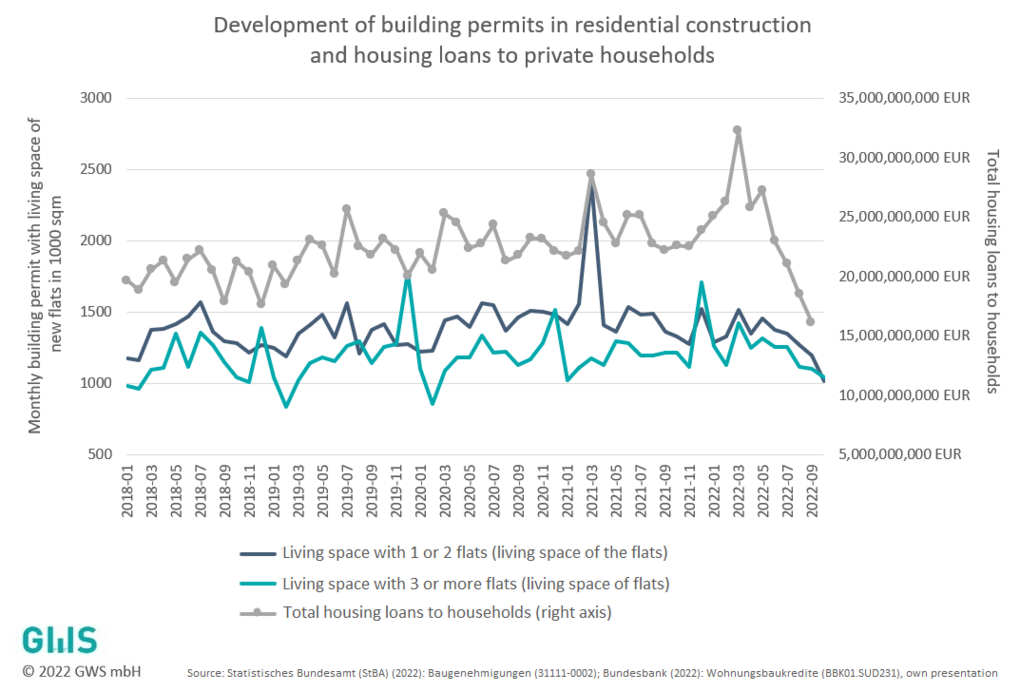

These price increases have hardly been able to break private demand and the material shortages have led to delays on construction sites. However, as a result of the ECB's key interest rate hikes, interest rates for housing loans in particular rose from 1.3% in January 2022 to 3.25% in October 2022. At the same time, real disposable incomes of private households have fallen due to high inflation. The rise in interest rates, coupled with the loss of purchasing power, has ultimately led to a noticeable decline in demand for new buildings. This has also been accompanied by a significant drop in housing loans and building permits for flats.

The figure shows the decline in the volume of housing loans to private households since January, which has fallen by a good 40 %. In contrast, the area of new dwellings approved has declined by less than 20 % compared to January.

The decline in the approved area of new dwellings to be built is reflected on the one hand in a general decline in the number of dwelling constructions, but also in a slight reduction in the living area for buildings with three or more dwellings. The average size of buildings with one to two dwellings, on the other hand, has risen to pre-pandemic levels, which, in conjunction with the lower credit volumes for housing construction, suggests a wealthier group of builders who are less dependent on credit. Therefore, it can be assumed that smaller, credit-financed residential buildings with one and two flats by private households are more price- and interest-sensitive than the larger residential buildings of this group (cf. StBA 2022).

In addition to industrial and commercial construction, which continues to be very active, residential construction seems to be losing ground when looking at the last few months. A longer-term view, on the other hand, gives less cause for concern, as demand remains at a high level and there have also been temporary declines in demand in the past.

Credit-financed construction activities have currently declined due to the double burden of prices and interest rates combined with uncertain disposable incomes. Wealthy households, however, continue to build, which can be assumed given the increase in average approved living space despite high construction costs. However, it can be assumed that with the first wage settlements, a little more security will return to disposable household incomes and credit-financed construction activities will recover somewhat.

Therefore, while recent developments should be closely monitored, they do not yet give reason to fear future years – especially as the underlying demand pressure from housing shortages in conurbations and the increased influx into them seems unabated. In addition, the economic stimulus packages and the reduction in value-added tax mean that the construction industry still has an increased construction backlog and full order books, which should provide sufficient buffer for short-term fluctuations in demand.

Sources: Bundesbank (2022a): Neugeschäftsvolumina Banken DE; Bundesbank (2022b): Wohnungsbaukredite an private Haushalte insgesamt. BBK01.SUD231; Statistisches Bundesamt (StBA) (2022): Baugenehmigungen. 31111-0002.

Other figures can be found here.