Are single-family homes more affordable due to the price decline?

Our figure of the month 04/2024

After property prices for a decade only knew one direction, they experienced a turnaround from the late summer of 2022 on. This was primarily due to the end of the ECB's zero interest rate policy and the subsequent continuous sharp rise in the key interest rate, which had an impact on housing loans. The combination of increased costs on financing, construction, and rising consumer prices in a tense political environment, reduced the demand for properties. With a shortage of housing supply that has persisted for years, demand is shifting to rental properties. While prices for properties slowed in 2022 but were still in a growth mode, prices have been falling continuously since the start of 2023. Residential properties for rent, on the other hand, are rising nationwide.

The price-income ratio falls for the first time in twelve years

Driven by inflation, wage increases were comparatively high last year. The affordability of a property, as measured by the price-to-income ratio (PIR), therefore increased as a result of falling prices: Last year, an employee with an average gross annual salary had to spend 9.8 times this annual salary to purchase a detached house with the characteristics of being free of occupancy, detached, with a living space of around 125 square meters in a medium location with average fittings and with a garage, whereas a year earlier it were almost eleven gross annual salaries. Before the coronavirus pandemic, however, it was still nine annual gross wages and a decade ago the PIR was less than eight. This shows how property prices have developed proportionally stronger in comparison to wages and the high price level at which detached houses continue to be priced.

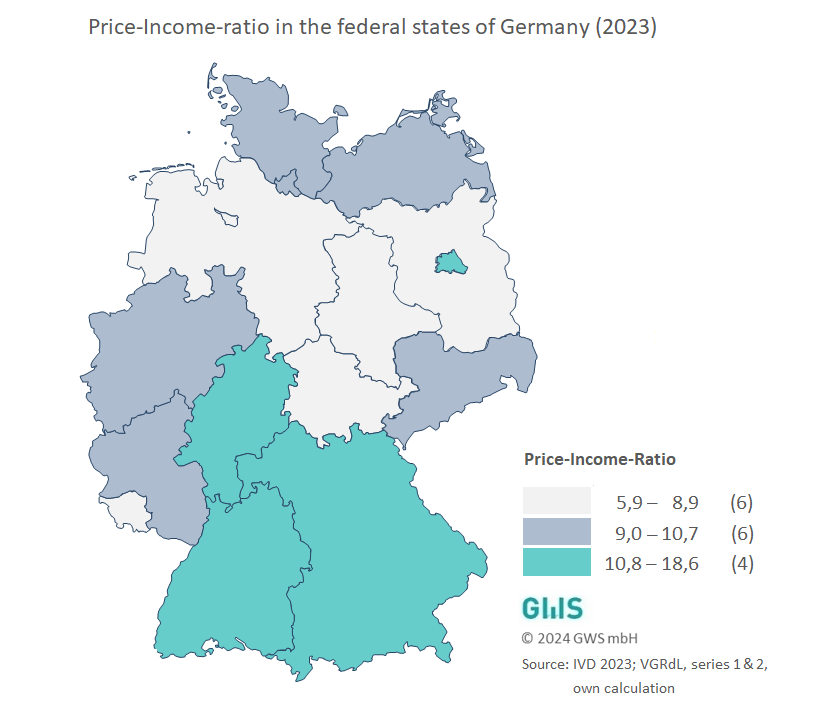

At a regional level, the PIR ranges from 19 times in Bavaria to 6 times in Thuringia. The most recent price developments for single-family homes at regional level have increased affordability overall but have hardly changed the affordability ratio between the federal states.

Berlin rises into the category of expensive federal states

In 2023, the German capital is one of the few federal states where prices for the type of house under review have risen. As a result, Berlin, with its previously average affordability and a PIR of 10.8, falls into the category of above-average expensive federal states. These expensive regions are marked in green on the map. The range of PIR in the respective categories expensive (green), average (blue) and more affordable (light gray) is shown in the legend. Due to the price gap between Berlin and the surrounding Brandenburg, it is to be expected that the demand for land and property in Brandenburg will increase and thus the pressure on prices.

Houses in Hamburg are becoming more affordable, but rental apartments are not

In contrast to Berlin, the Hanseatic city of Hamburg, which has always been characterized by very high price levels, has recorded a noticeable price decline of over 13% in 2023. As a result, the PIR has fallen by over two points and currently stands at 10.3. In relation to the other federal states, the Hanseatic city is thus among the states with average affordability for the first time. However, the strongest demand in Hamburg is concentrated on rental properties, which is related to the PIR but above all to the structure of the housing stock. Demand pressure, which is being driven by a growing population and a simultaneous decline in building permits, is expected to increase and with it rents.

Other figures can be found here.