Prices for building materials remain at a high level

Our figure of the month 02/2024

The construction industry, one of the most important sectors of the domestic economy, is currently in crisis. According to the Ifo Institute's business climate indicator, sentiment in the construction industry continued to deteriorate in January 2024. Business expectations fell to minus 50 points and are therefore below the expectations of the last four years, which were already characterised by the coronavirus crisis as well as the Russian war of aggression and the resulting energy crisis. The Federal Statistical Office also recently reported both a decline in turnover and a further decrease in incoming orders in the construction industry. In November 2023, turnover fell by 3.2 % in real terms compared to the same month of the previous year. New orders, which are considered a leading indicator, fell by 2.7 % in real terms in the same period. However, the trend here was divided into two parts: While incoming orders in civil engineering fell by 6.1 % in real terms, they rose by 0.6 % in building construction.

The main reasons for the economic slump in the sector last year, particularly in new building construction in the main construction sector, are the sharp rise in construction costs in recent years as a result of higher interest rates and prices for building materials.

This is a good reason to take a closer look at the development of prices for selected building materials as part of our figure of the month for February.

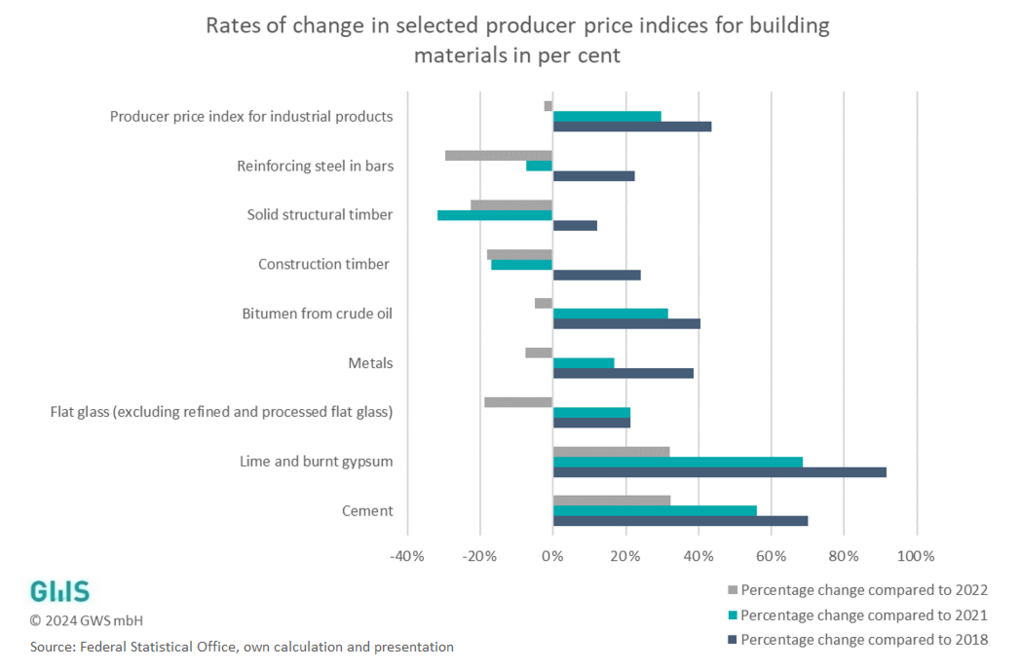

Overall, prices for building materials remained at a high level in 2023, even though different trends were observed for the various building materials such as cement, wood and steel.

After 2022, the high price increases continued in 2023, especially for mineral building materials such as cement (+ 32 % compared to 2022) or lime and burnt gypsum (+ 32 % compared to 2022).

In contrast, there are signs of a slight trend reversal for metal building materials. While prices for metals fell by around 7.6 % overall compared to 2022, the price of reinforcing steel in bars fell by around 29.6 % in the same period. Nevertheless, prices for metals in 2023 were around 16.8 % higher than in 2021.

The price of petroleum-based bitumen, which is important for road construction and roof waterproofing, fell by around 4.9 % in 2023 compared to 2022. Here, too, prices remained at a very high level, still around 31.6 % above the 2021 level. Prices for flat glass for the construction of windows, glass doors or walls also fell in 2023 (-18.9 %), but also remained well above the 2021 level (+21.1 %).

Building materials made of wood appear to have undergone a trend reversal: Solid structural timber (-22.6 %) and construction timber (-18.1 %), for example, became significantly cheaper in 2023 compared to 2022, with prices here also falling well below the 2021 level.

Even if individual building materials or building material groups recorded falling prices in 2023, this should not obscure the fact that they are still far above the level before the coronavirus crisis and the subsequent energy crisis caused by the Russian war of aggression. This is illustrated by the comparison with the price level in 2018 shown in the figure above. While the price for solid structural timber, for example, is around 12 % higher than in 2018, the prices for lime and burnt gypsum have almost doubled in the same period with an increase of 91.6 %.

By comparison, producer prices as a whole also fell slightly in 2023 compared to 2022 (- 2.4 %). However, they are also almost 30 % above the 2021 level and even 43.5 % above the pre-crisis level of 2018.

Other figures can be found here.